Finance

Data-Backed Decisions for Smarter Investments and Growth. Leverage AI-powered market research with portfolio management tools to identify opportunities, mitigate risks, and maximize returns across asset classes.

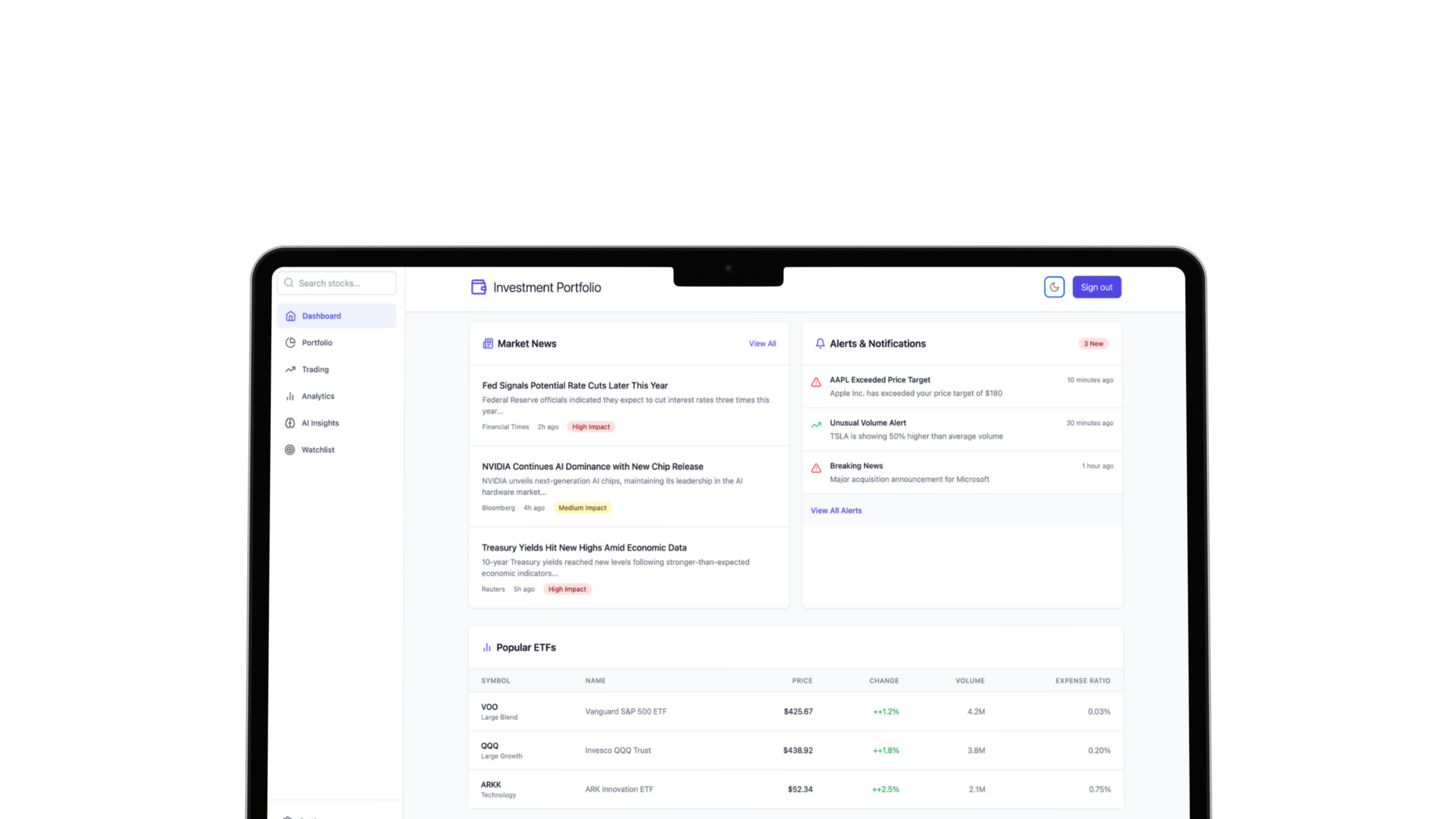

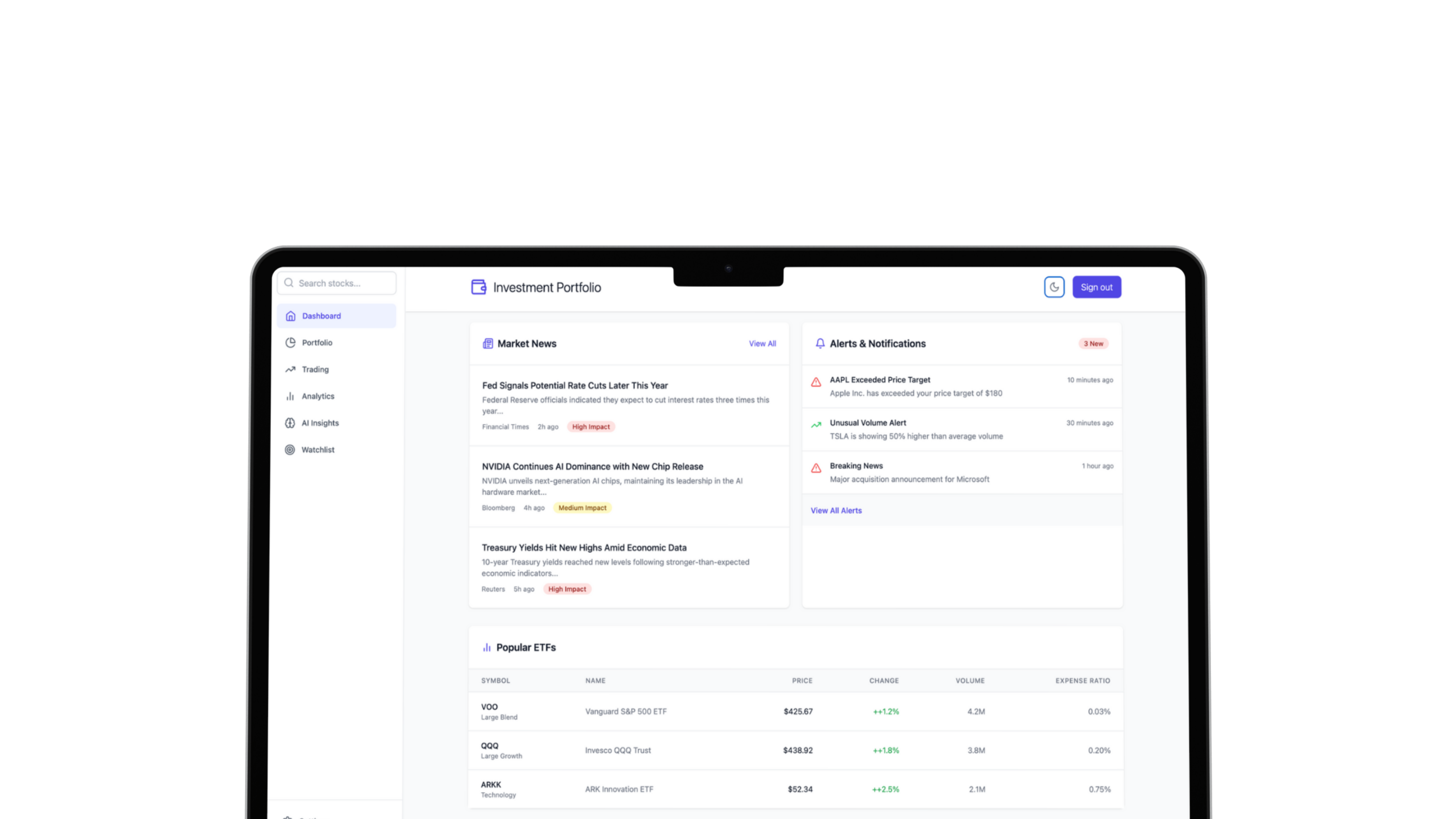

Elevatics investment research solution

Comprehensive Market Research, Simplified for your Investment

AI-Driven Market Intelligence & Portfolio Optimization

AI-powered market research with portfolio management tools to identify opportunities, mitigate risks, and maximize returns across asset classes.

AI-Powered Market Research

Uncover Trends, Predict Shifts, and Outperform Competitors

- •Real-Time Data Aggregation: AI scrapes global financial news, earnings reports, social sentiment, and macroeconomic indicators.

- •Predictive Trend Analysis: Machine learning models forecast market movements, sector performance, and consumer behavior.

- •Competitor Benchmarking: Track rivals’ strategies, market share, and ESG metrics with automated dashboards.

- •Benefits:

- •Reduce research time by 60% with AI-curated insights.

- •Identify emerging opportunities (e.g., green energy, AI startups) ahead of the curve.

- •Validate investment theses with data-driven scenario modeling.

Intelligent Portfolio Optimization

Balance Risk and Reward with Precision

- •Dynamic Asset Allocation: AI rebalances portfolios based on risk tolerance, market volatility, and return objectives.

- •Tax-Loss Harvesting Automation: Optimize tax efficiency by intelligently offsetting gains and losses.

- •Alternative Investment Analysis: Evaluate private equity, crypto, and real estate using predictive valuation models.

- •Benefits:

- •Achieve 10–15% higher annualized returns with AI-driven strategies.

- •Minimize downside exposure during market downturns.

- •Diversify portfolios beyond traditional asset classes.

Risk Management & Compliance

Protect Assets, Ensure Regulatory Adherence

- •Risk Scoring Engine: AI quantifies geopolitical, liquidity, and credit risks for each asset.

- •Regulatory Alerts: Stay compliant with SEC, MiFID II, GDPR, and ESG reporting requirements.

- •Stress Testing: Simulate black-swan events (recessions, pandemics) to assess portfolio resilience.

- •Benefits:

- •Reduce compliance costs by 40% with automated reporting.

- •Avoid costly penalties through real-time regulatory updates.

- •Strengthen investor trust with transparent risk disclosures.

Sentiment & Behavioral Analytics

Decode Market Psychology

- •Social Media Sentiment Tracking: NLP analyzes Reddit, Twitter, and news headlines to gauge retail investor sentiment.

- •Institutional Flow Monitoring: Detect insider trading patterns or hedge fund positioning via AI-driven data leaks.

- •Bias Detection: Flag emotional decision-making in portfolio adjustments.

- •Benefits:

- •Capitalize on market euphoria or panic before trends peak.

- •Align strategies with institutional money movements.

- •Improve discipline by reducing human bias.

ESG & Impact Investing Tools

Invest with Purpose, Measure with Precision

- •ESG Scoring: AI evaluates companies’ sustainability practices, diversity metrics, and carbon footprints.

- •Impact Reporting: Automate ROI + ESG performance dashboards for stakeholders.

- •Greenwashing Detection: Identify misleading claims in corporate sustainability reports.

- •Benefits:

- •Attract ESG-focused investors with auditable impact data.

- •Align portfolios with UN SDGs (Sustainable Development Goals).

- •Avoid reputational risks tied to unethical investments.

learn how AI Analyze, predict, manage, and act on financial data across equity markets.